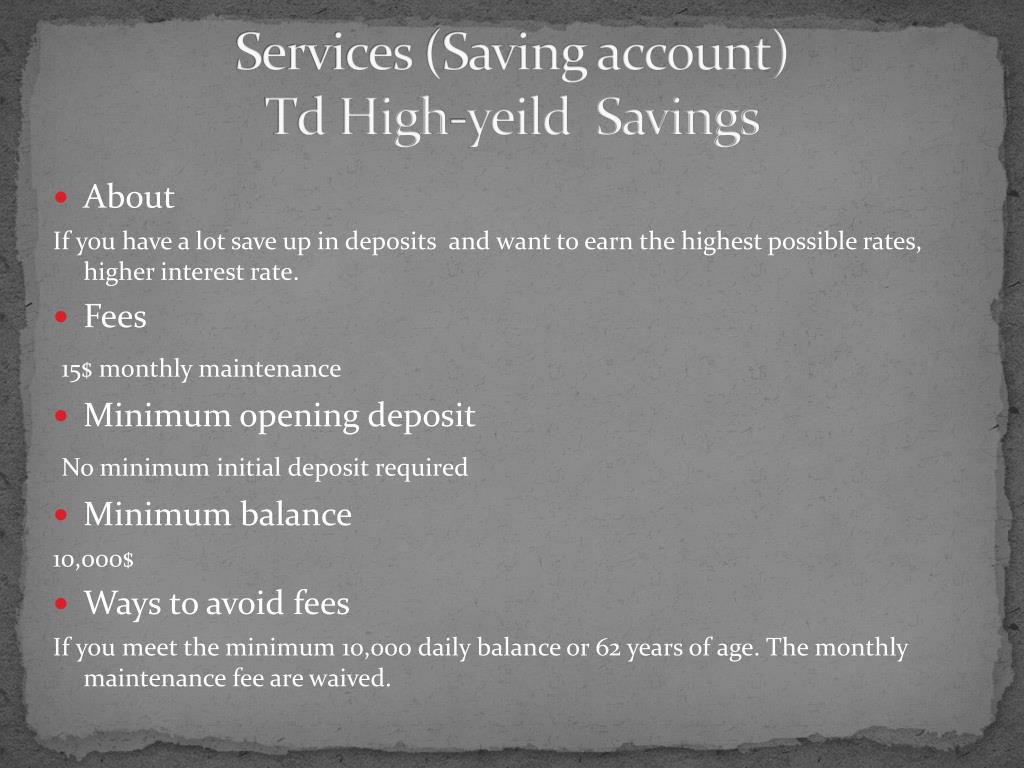

Td High Interest Savings Account

A TD Beyond Savings IRA may be a good choice if you want a competitive interest rate and the flexibility to make contributions at any time $20,000 opening deposit Additional contributions allowed 3.

TD Canada Trust offers you the option of a High Interest TFSA Savings Account or GICs and Term Deposits within a TFSA. Both protect your principal investment and offer predictable returns.

- The TD Investment Savings Account is a product for investors seeking flexible fixed income options. Grow your savings in a product that pays a competitive interest rate, and enjoy the security of having your money held in accounts that are.

- The TD Tax-Free Savings Account helps Canadians save more money without having to pay taxes on interests. Learn more about this TD banking solution today! High Interest TFSA Savings Account TD Canada Trust.

High Interest TFSA Savings Account

The High Interest TFSA Savings Account puts you in control of your money.

It offers you –

- A competitive interest rate so you can enjoy tax-free growth in a high-yield registered savings account

- Steady, predictable returns

- Flexible access to your money

- The convenience of Pre-Authorized Transfer Service

- Eligibility for coverage under the Canada Deposit Insurance Corporation (CDIC)

GICs, Term Deposits and your TFSA

If you’re looking for guaranteed principal and interest in a low-risk investment, then Guaranteed Investment Certificates (GICs) and Term Deposits could be the right fit for your TFSA.

- You get a solid, secure investment with no surprises

- Your principal is fully protected, and interest rates are guaranteed1

- You have the comfort of steady, predictable investment returns

- You can choose from a full range of terms, as well as innovative features that combine premium rates with investment flexibility

- Your investments are eligible for coverage under the Canada Deposit Insurance Corporation (CDIC)

Ask about our Market Growth GICs2

- Returns on Market Growth GICs are linked to changes in leading stock market indices

- Market Growth GICs provide growth potential while guaranteeing your principal

Td High Interest Savings Account Rate

To open a TD Canada Trust TFSA, simply visit any TD Canada Trust branch, call 1-866-222-3456 or apply online now.

Td Bank Savings Interest Rates

2 The principal amount of a Market Growth GIC will be repaid at maturity. Changes in the index to which the return on a Market Growth GIC is linked will affect the interest payable on the GIC. Interest is payable only up to a maximum amount set at the time of purchase. No interest will be payable in the event that the index to which the return on the GIC is linked has declined or does not change from its level at the time of purchase. Market Growth GICs are not redeemable prior to maturity. A disclosure statement with complete details of the features of Market Growth GICs is available at any TD Canada Trust branch.